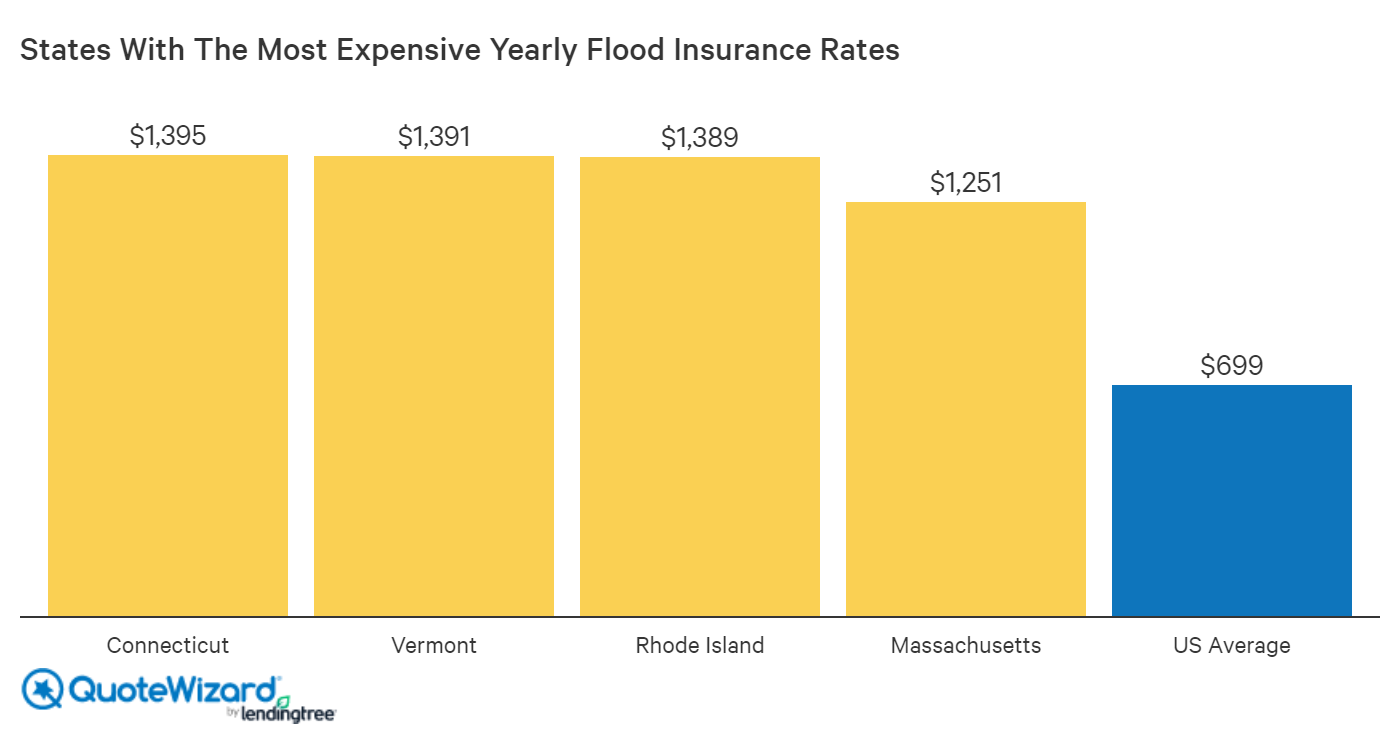

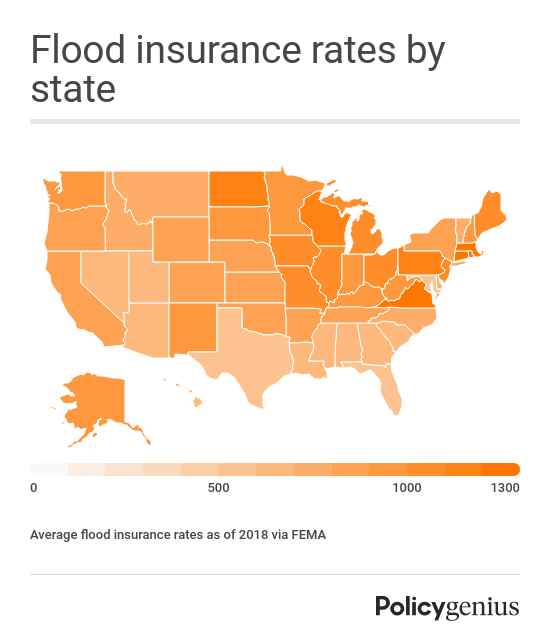

The average cost of national flood insurance program nfip coverage was 707 according to the latest data provided by the federal emergency management agency fema.

Ae flood zone insurance cost.

In low to moderate risk areas premiums range from roughly 130 to 450 per year for homes.

You ll also pay more in fees.

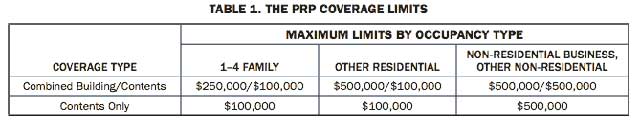

Coverage amounts and type of coverage federal government or private.

In the most extreme cases you may pay more than 300 as much to insure a house in a zone a area than a zone v one.

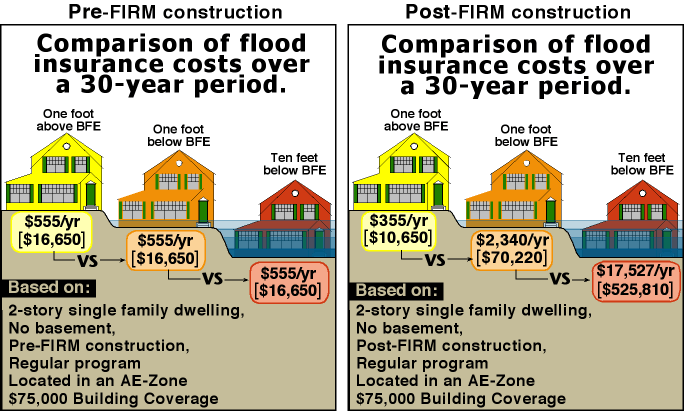

Depending on the zone your home is located in flood insurance rates can range from around 190 to more than 2 000.

You may also receive a higher flood insurance quote if your house is used as a rental property or if you occupy it less than half the year which are both common scenarios for florida homeowners.

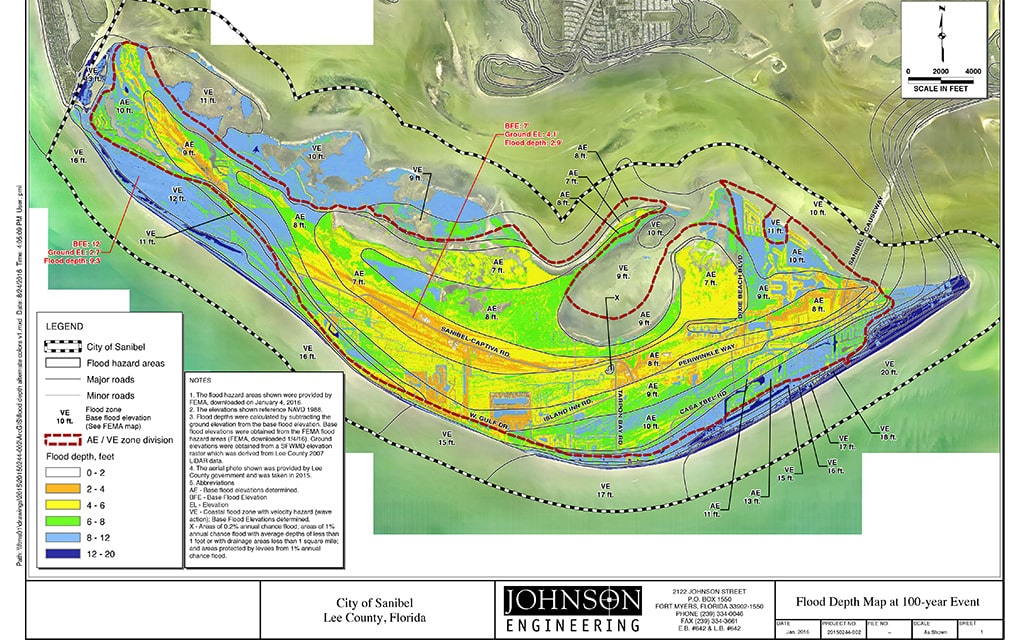

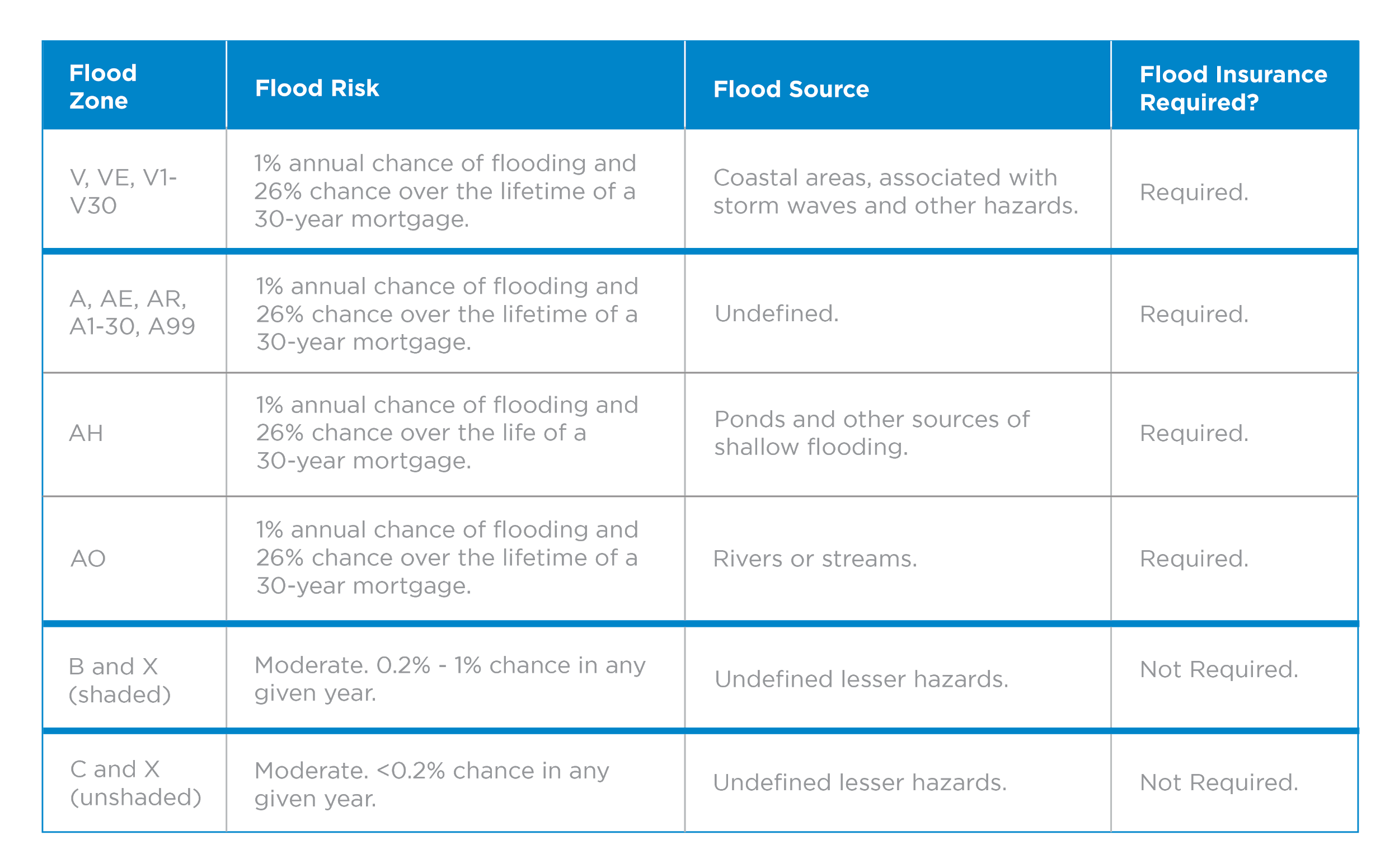

The type of flood zone you live in has a huge effect on the price of your flood insurance.

Flood insurance rates vary from home to home based on a number of factors including the home s.

Costs vary by state and can be as cheap as 550 a year.

The average cost of flood insurance in 2018 was 699 per year or 58 a month through the national flood insurance program nfip.

The chart above shows flood insurance costs for florida homes that qualify for the preferred risk program.

Rates of june 19 2017.

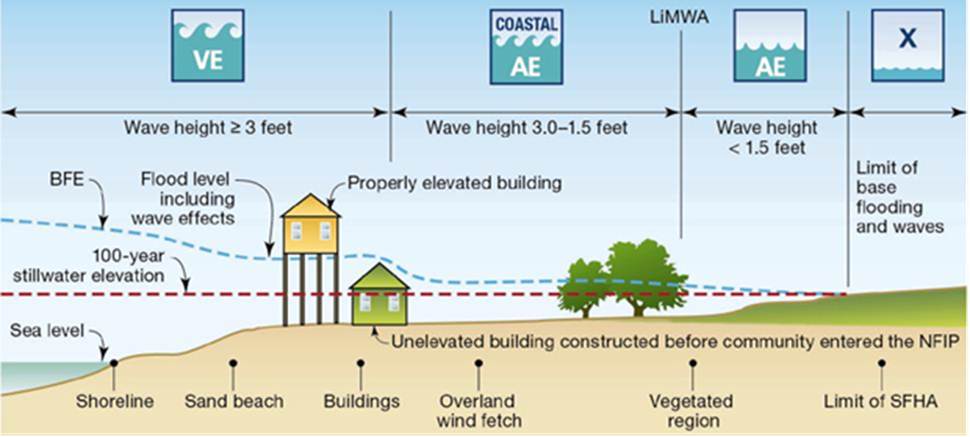

Flood zone ae also referred to as the 100 year flood zone has the highest premiums other than coastal areas.

These are generally because most of the structures have a negative base flood elevation.

Well there are a few things that have a major impact on flood premiums in these zones.

In high risk zones they can reach into the thousands.

Updated september 17 2020 by chris moon the average flood insurance policy obtained through the national flood insurance program nfip costs 708 per year.

Home insurance policies do not cover floods which means you ll need a separate flood policy to be fully protected.